Scalable Vendor Revenue

How SVR Helped VendorPM Double Vendor Revenue and increased retention by 90%

About:

When VendorPM began preparing for an upcoming funding round, one priority became unavoidable: we needed a monetization engine that could scale predictably. Marketplace usage was healthy, but revenue from Non-Preferred Vendors (NPVs) wasn’t compounding in a way that would stand up to investor scrutiny. SVR (Scalable Vendor Revenue) became the strategy that closed that gap. Ultimately doubling vendor-generated revenue and materially strengthening VendorPM’s ability to raise funds by proving a clearer, repeatable path to revenue growth.

The problem: monetization wasn’t scaling and churn signaled misalignment

VendorPM had already tried two common approaches:

Take-rate models, which struggled to scale cleanly for this marketplace.

A two-tier subscription model (Plus / Pro):

Plus: unlimited access to opportunities (RFXs)

Pro: the same access, plus top placement via a “Featured Profile”

The model looked simple, but it created a consistent failure mode: expectations inflated faster than outcomes. Unlimited opportunities led some vendors to assume invites implied strong intent to award. When awards didn’t materialize, vendors churned—often in the 5–7% monthly range. That churn wasn’t just a retention issue; it was a signal that the value being sold didn’t match what vendors believed they were buying.

In a fundraising context, churn plus unclear expansion dynamics is a red flag. The business needed a monetization strategy that was more predictable, easier to explain, and more scalable.

The principles: protect the marketplace while growing ACV

SVR was built around a few non-negotiable operating principles:

Don’t inhibit supply (marketplaces die when participation becomes paywalled)

Increase liquidity (pricing should lead to more matches, not fewer)

Provide one low-ACV option to retain vendors with lower willingness to pay

Provide one high-ACV option to expand revenue from growth focused vendors

These principles mattered because marketplaces are fragile. A monetization strategy that reduces participation can break liquidity, which then harms outcomes for everyone.

The insight: stop selling “wins” - sell “visibility”

The fundamental shift was decoupling payment from something vendors can’t fully control (award rates, buyer behavior, seasonality). If vendors pay expecting outcomes, they churn when outcomes vary.

So SVR repositioned the value as exposure, not “success.”

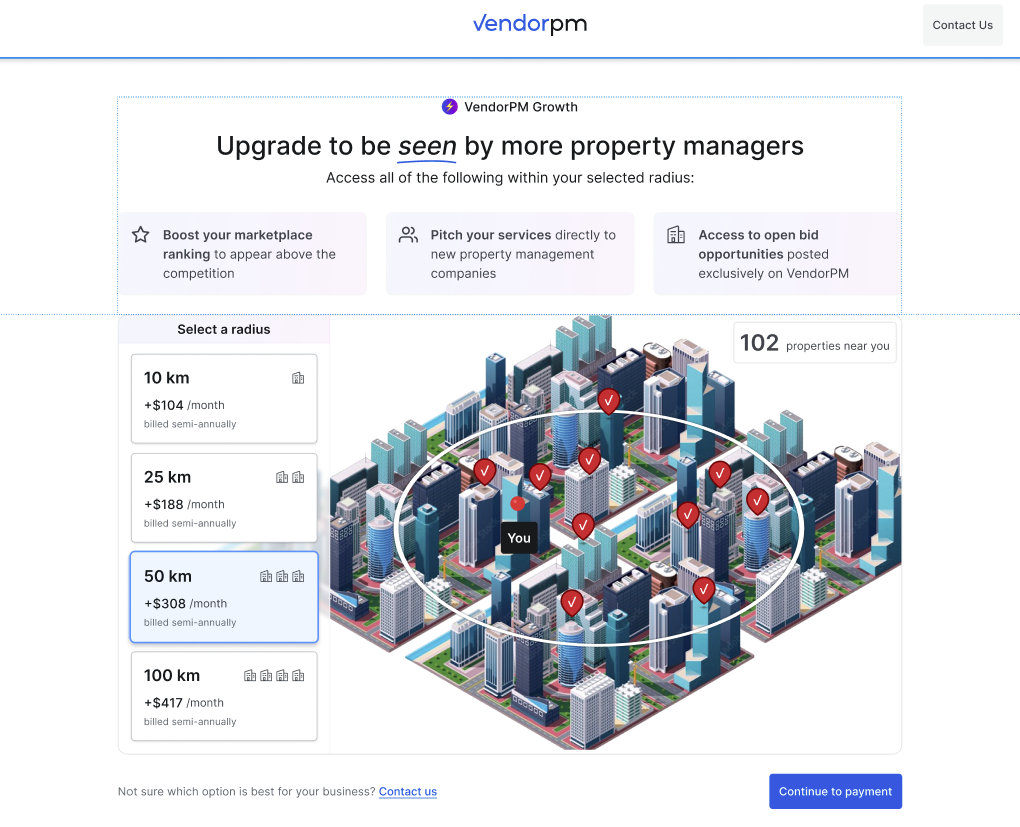

The solution: the radius-based “Growth” exposure plan

We introduced an exposure-based model packaged as the Growth plan:

Vendors keep access to opportunities (no paywall on participation)

Paid vendors receive improved marketplace visibility

Visibility scales by service radius—pay more for a larger exposure area

It’s a clean value exchange: vendors pay for distribution in the geography where they want to win work, not for a promise that they will.

Pricing: grounded in real willingness-to-pay

We validated pricing through vendor research and willingness-to-pay surveys (50 vendor responses), then structured tiered pricing around radius:

10 km: ~$1,188 ARR

25 km: ~$2,268 ARR

50 km: ~$3,588 ARR

50 km+: ~$5,040 ARR

Pricing was displayed monthly (to reduce sticker shock) and billed semi-annually, and we retained a premium “Featured” concept for the highest-intent vendors.

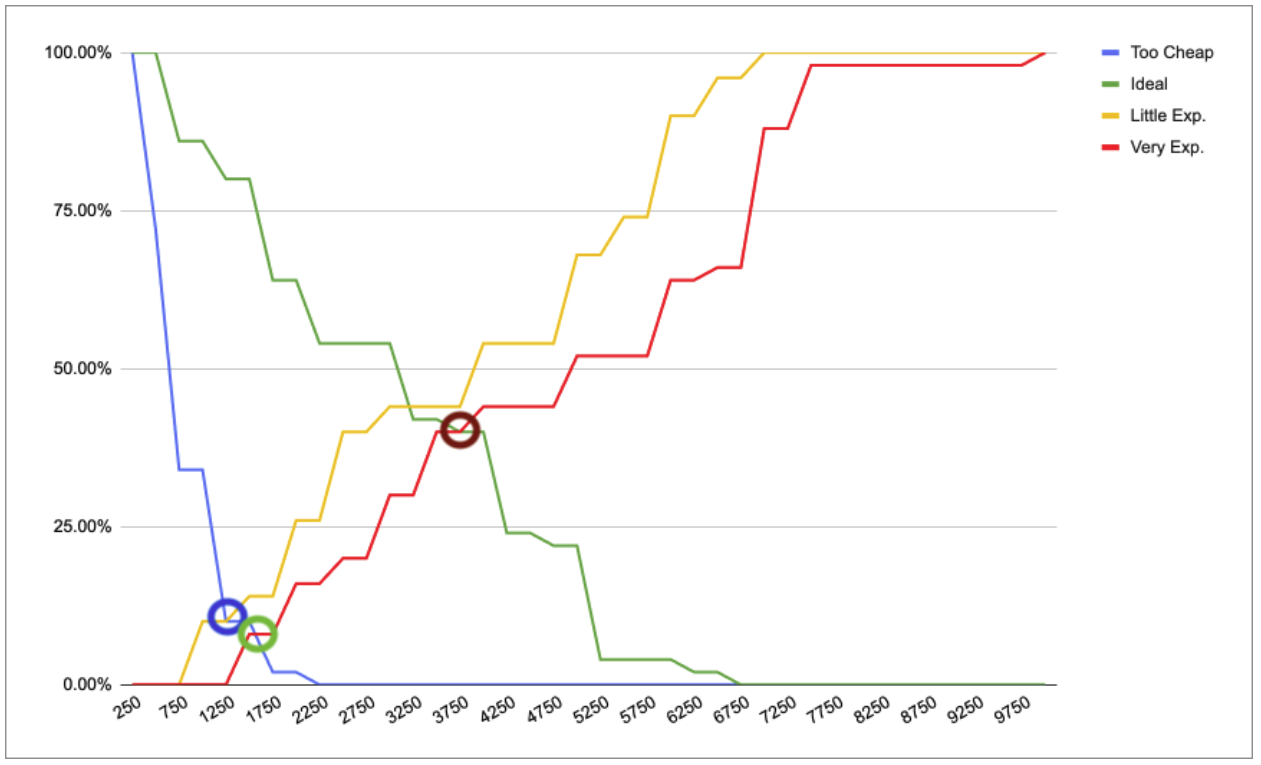

Willingness to pay: leveraging Van Westendorp price charts

SVR did not guess at pricing, rather pricing was validated through willingness to pay research layered with radius based awarded GMV per vendor. The research included a survey of 50 vendors, focused on willingness to pay for radius based exposure. The survey approach followed a price sensitivity method where vendors were asked to provide prices that felt:

Too cheap

A little expensive

Very expensive

Ideal

Those responses were plotted as Van Westendorp price charts to identify an acceptable price range and a likely optimal price point.

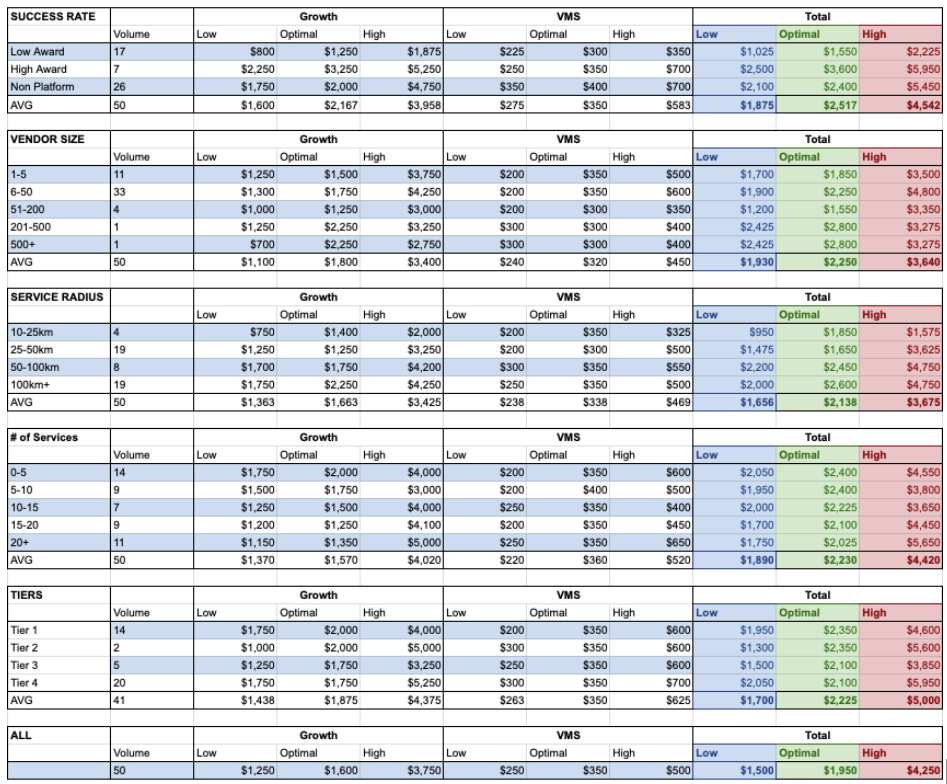

Beyond general pricing, the work also included segmentation to ensure pricing and packaging could scale across different vendor profiles.

Segmentation dimensions:

Vendor success rate

Vendor size

Vendor service radius

Vendor number of services

Two intent segments were identified that influenced packaging strategy:

Stay and Maintain vendors who use the platform to maintain a small number of existing relationships and are less likely to pay for growth features.

Growth vendors who actively seek new relationships and are more likely to pay for radius based exposure.

88% of vendors surveyed agreed they would pay for an exposure service within a defined radius, and 88% agreed pricing should scale as radius increases. This is exactly the kind of evidence that strengthens confidence in monetization during fundraising.

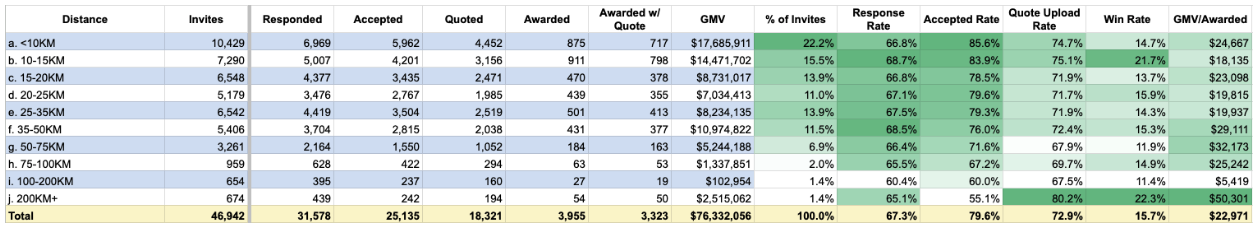

Vendor Service Radius: GMV awarded per radius

This information connects how a Vendor’s location and work radius affect their business prospects. Vendors within 50km of their business location have more opportunities, while those operating beyond 50km may encounter fewer opportunities, however, those opportunities which extend the radius are potentially more lucrative.

Using the Vendor’s business location as a central location, preliminary data was focused on the distribution of invites, awards, and GMV within radius tiers with the Vendor’s business as the central point

Data shows a relatively flat distribution of invites, award rates and GMV between 0-50km

Understood that vendors who work within a 50km radius of their business location may have plenty of opportunities

Above 50km, invites, award rates and GMV decrease, but the GMV per award increases

Understood that vendors who work within a radius greater than 50km of their business may have a higher awarded value per opportunity

Distribution that actually delivered: ranking boosts + self-serve checkout

Exposure only works if it’s implemented in product behavior. Growth included clear ranking boosts tied to proximity and category ranking logic so vendors could feel the impact.

Equally important: we designed Growth as a self-serve upgrade, positioned as an add-on within checkout (VMS/compliance flow). That made revenue scalable without relying on incremental sales headcount—another investor-friendly trait.

Rollout designed for confidence: market toggles + grandfathering

To reduce risk, we proposed a market-first launch (Ontario) with the ability to turn monetization on/off per market. We also built a migration plan to protect existing revenue and relationships:

Plus/Pro/Featured vendors were grandfathered into Growth

Vendors were mapped to tiers based on existing service radius

Compliance checkpoints controlled when certain benefits activated

This minimized churn during the transition and kept the go-to-market story clean.

The outcome: doubled vendor-generated revenue—and a stronger raise

SVR worked because it aligned monetization with vendor motivation, preserved marketplace supply, and created a clearer upgrade path for growth-focused vendors. The result was a step-change in vendor monetization, 5x increase in number of paid vendors, doubled annual revenue per user, and, retention increase of 90% for base plan customers.

In short: SVR didn’t just improve the marketplace economics, it helped VendorPM show investors a more credible path to predictable growth.